We got it.

Thank you for contacting us.We’ll get back to you as soon as possible.

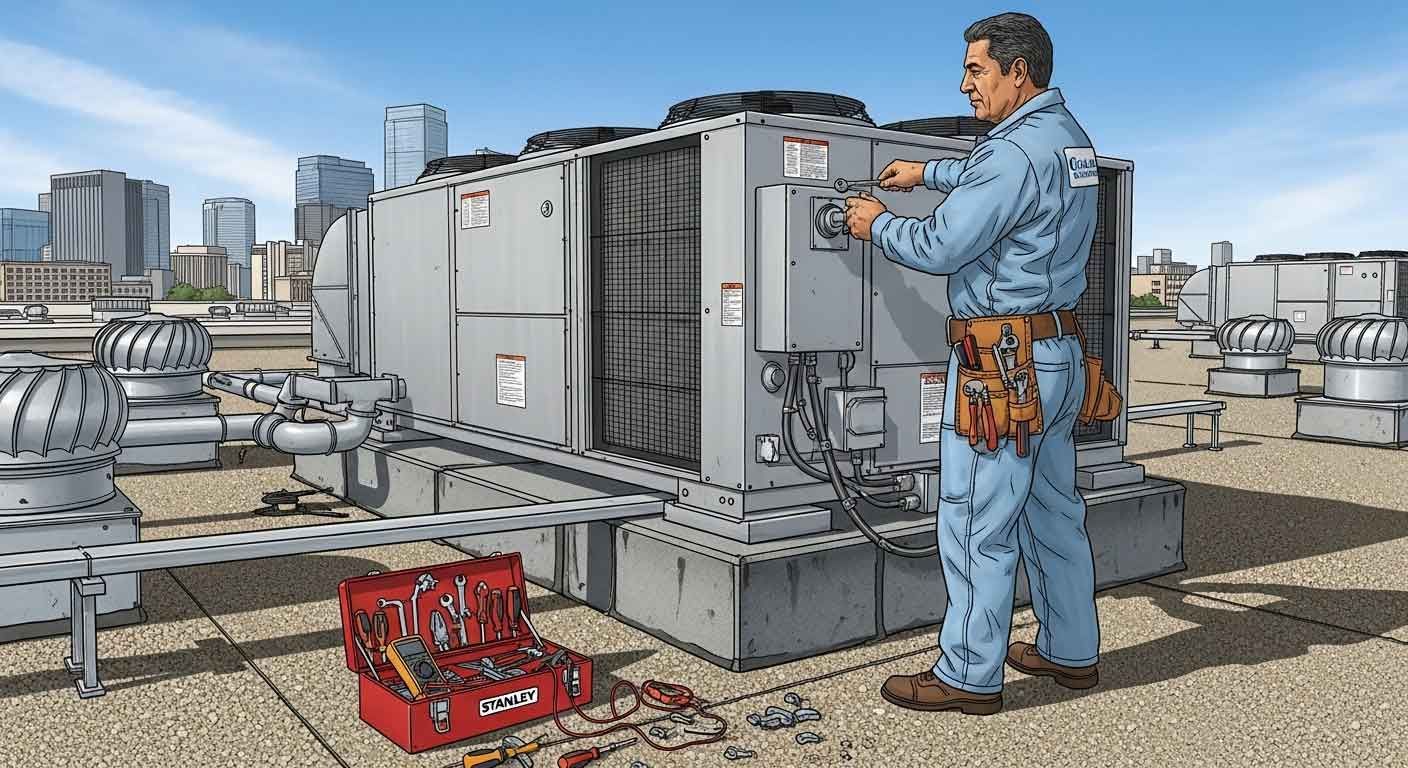

Commercial HVAC Contractors Claiming Every Market Claim None

By Doug Mansfield • January 27, 2026

The Credibility Problem with Geographic Scatter

I see commercial HVAC contractor websites that communicate geographic coverage poorly. The footer lists Houston, Beaumont, College Station, Katy, Sugar Land, and The Woodlands. The homepage claims "Houston's premier mechanical contractor." Service pages mention "serving Southeast Texas."

This creates confusion, not credibility.

When a mechanical contractor claims local dominance in Houston while simultaneously listing coverage across 100+ miles of Southeast Texas, procurement managers don't see comprehensive coverage. They see scattered capability. The question becomes: if you're the premier contractor in Houston, why are you driving to College Station for maintenance contracts?

The problem isn't geographic expansion. The problem is unclear communication about coverage areas.

The Rearview Mirror Approach to Market Selection

What I observe is contractors selecting target markets using past project history. They've completed jobs in Beaumont, Bryan, and Victoria over the past five years, so those cities get added to the website footer and Google Business Profile service areas.

This is driving with the rearview mirror.

Past projects don't always indicate future opportunity. A one-time design-build project in Victoria three years ago doesn't mean Victoria represents strategic growth potential. It means you won the bid on a specific project. That's the entire data set.

Future planning requires different questions. Where are facility managers actively looking for new mechanical contractors? Where is commercial construction activity increasing? Where do your competitors have thin coverage? Which markets have the right mix of opportunity density and competitive weakness?

Targeting everywhere you've ever done a job dilutes resources across markets with different opportunity levels. Some markets might generate three qualified RFPs annually. Others generate twenty. Resource allocation should follow opportunity concentration, not historical accident.

Strategic Market Selection for Geographic Growth

Geographic expansion works when the selection process is strategic, not historical. This means evaluating markets based on criteria that predict future opportunity:

- Commercial construction activity trends in the market

- Existing competitor density and their reputation strength

- Drive time from current shop location for emergency service

- Concentration of facility types that match your expertise (hospitals, schools, manufacturing plants, office complexes)

- Presence of property management firms that control multiple buildings

- Local code requirements that create barrier to entry for out-of-market contractors

Markets that score well across multiple criteria become primary targets. Markets that score poorly get eliminated regardless of past project history.

Once target markets are selected, website structure needs to reflect the reality of your position in each market. This isn't about claiming equal dominance everywhere. It's about honest communication of capability and coverage.

Website Structure for Multi-Market Coverage

Separate landing pages for each target market solve the credibility problem. Houston gets a dedicated page. Beaumont gets a dedicated page. College Station gets a dedicated page. Each page communicates clearly what contractors can expect in that specific market.

The messaging differs between established markets and expansion markets. In Houston, where you've operated for fifteen years with multiple completed projects and existing maintenance contracts, you can legitimately claim established presence. The Houston page shows project portfolio, client references, and emergency response capability.

In Beaumont, where you're building presence with two completed projects and actively pursuing maintenance contracts, you position as expanding coverage. The Beaumont page states clearly: "Expanding mechanical service coverage to Beaumont commercial facilities." No claims of dominance. No "premier" language. Honest communication that you're capable, available, and building relationships in that market.

Response time communication varies by market distance. In Houston, you offer two-hour emergency response because you have service trucks stationed locally. In Beaumont, you offer same-day response because the drive requires planning. In College Station, you offer next-day response for routine service and 24-hour emergency callback.

Facility managers appreciate clarity. They need to know what happens when a chiller fails at 3 AM on Saturday. Vague "serving Southeast Texas" language doesn't answer that question. Market-specific response commitments do.

Balancing Opportunity and Competitive Density

Broader geographic targeting increases competition exposure. A contractor operating only in Houston competes against Houston mechanical firms. A contractor claiming coverage across six cities competes against every mechanical contractor in those six cities plus regional players operating at scale.

This matters for bid lists. When a facility manager in College Station needs mechanical work, they're comparing you against College Station-based contractors with faster response times and established local relationships. You're asking them to choose the Houston contractor driving 90 miles over the College Station contractor driving 10 minutes.

You can win those comparisons, but you need differentiation beyond geographic proximity. Specialized expertise in specific facility types works. Certifications that local contractors lack works. Proven track record with complex systems works. Generic "quality and experience" messaging doesn't overcome the proximity disadvantage.

Geographic expansion makes sense when the opportunity in new markets justifies the increased competitive exposure. Fast-growing suburban markets sometimes have more demand than local contractor capacity can handle. Industrial corridors with specialized facility types might have thin contractor expertise. Those scenarios create legitimate expansion opportunities.

The website needs to communicate why a facility manager should consider the non-local contractor. What do you offer that justifies the drive time? The answer can't be "we're willing to drive here." The answer needs to be capability, expertise, or certification advantages that matter more than proximity.

Repositioning for Geographic Expansion

This repositioning requires strategic market selection followed by honest website structure. The selection process identifies markets where opportunity concentration justifies competitive exposure. The website structure communicates clearly what contractors can expect in established markets versus expansion markets.

What I find is that mechanical contractors sometimes need external perspective to evaluate market opportunity objectively. Internal familiarity with past projects creates bias toward markets where you've worked before, even when those markets don't represent future growth potential.

Mansfield Marketing works with commercial HVAC and mechanical contractors to develop geographic expansion strategies as part of holistic marketing repositioning. We identify target markets based on opportunity analysis, not project history. We structure website landing pages that communicate coverage honestly per market. We develop messaging that differentiates beyond proximity when competing against local contractors.

Contact Mansfield Marketing to discuss repositioning your mechanical contracting marketing from scattered geographic claims to strategic market expansion by requesting a quote or calling us at (713) 936-5557.

Written by Doug Mansfield | President, Mansfield Marketing

Connect with Doug Mansfield on LinkedIn