We got it.

Thank you for contacting us.We’ll get back to you as soon as possible.

Why Contract Manufacturers Get RFQs for Prototypes Instead of Production Runs

By Doug Mansfield • January 20, 2026

The Similarity Problem

I review contract manufacturer websites regularly, and what strikes me is how similar the positioning appears across the industry. Precision manufacturing. Quality components. Comprehensive capabilities. Trusted partnerships.

These statements describe real capabilities. They also describe the competition, which creates a filtering problem for production buyers.

When I look at this from a procurement manager's perspective, someone at an automotive OEM searching for a partner who can deliver 50,000 parts quarterly, I see the same language from facilities built for high-volume production and shops that primarily handle prototype work. When differentiation is invisible, inquiries skew toward lower-volume requests.

The Generic Manufacturing Position

Pull up several contract manufacturer homepages. What I notice is variations of the same core messages appearing across different facilities: precision, quality, comprehensive capabilities, trusted partnerships.

A prototype shop uses this language. A flexible job shop that accepts any volume uses this language. A production facility with $10 million in annual capacity uses this language.

What happens is buyers can't distinguish operational capability from marketing language. When websites sound similar, buyers assume operations are similar. Small batches. Flexible schedules. Low minimums.

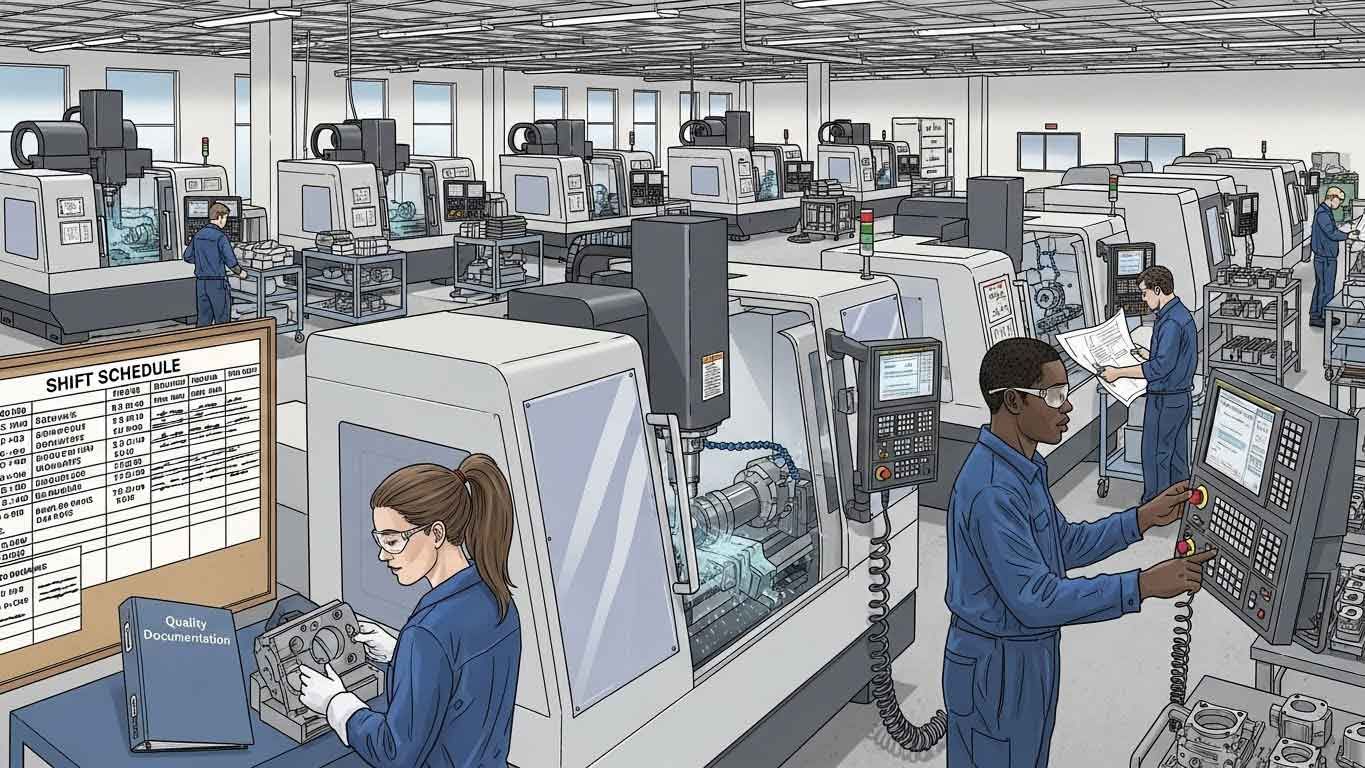

Production buyers aren't evaluating flexibility. What I know they're verifying is systems, capacity, and documentation that prove you can handle their volume without quality degradation across tens of thousands of parts.

What Production Buyers Actually Verify

I've learned that OEMs evaluating production partners look for specific operational evidence before submitting RFQs.

Quality management systems serve as table stakes. ISO 9001 certification appears prominently on many manufacturing websites. For aerospace work, AS9100D certification. For automotive, IATF 16949. What I observe is these aren't marketing differentiators. They're minimum requirements.

But certification badges don't communicate capacity. A shop certified to AS9100D might run two shifts with eight machines or three shifts with forty machines. The certification confirms your quality system exists. It doesn't indicate available production volume.

Capacity details separate production facilities from job shops. What production buyers need is equipment counts, shift structures, and current utilization. They're asking whether you can absorb their volume without disrupting existing commitments or sacrificing delivery schedules.

Documentation systems prove you can track lot traceability, maintain first article inspection records, and provide certificates of conformance for production runs. Prototype shops often don't build these systems. Production facilities can't operate without them.

Supply chain integration becomes critical at volume. What I see is production buyers want to know if you manage raw material inventory, if you have backup suppliers for critical materials, and whether you can handle vendor-managed inventory programs.

The Language Gap

Here's what typically appears on contract manufacturer homepages: "We deliver precision components with exceptional quality and customer service."

Here's what production buyers need to read: "We maintain ISO 9001:2015 and IATF 16949 certification. Our facility runs three shifts with 45 CNC machining centers. Current capacity supports production runs from 10,000 to 500,000 parts annually with full lot traceability and vendor-managed inventory programs."

The first statement could apply to any shop. The second statement can only be true for a production facility.

What I've observed is generic language attracts generic inquiries. Specific operational details attract qualified production buyers.

Why Prototype Work Drowns Out Production Inquiries

When a website communicates broad capability, it receives broad inquiries. The contact form doesn't filter by volume. The phone doesn't screen for recurring orders.

Prototype requests arrive constantly because they're easy to submit. A product designer needs three parts to test fit and function. They search "precision machining," find sites that look capable, and submit quote requests. Takes five minutes.

Production buyers move differently. They're evaluating long-term partnerships. They research quality systems, review case studies, and verify capacity before reaching out. If sites don't provide this verification, they move to the next candidate.

The result: Sales teams spend weeks quoting prototype work that converts at low rates. The production buyers facilities actually need never submitted RFQs because sites didn't confirm capacity to handle their requirements.

What Changes the Inquiry Mix

Production positioning starts with the homepage. Not buried in an "About" page. Not hidden in a capabilities PDF. What I recommend is the opening paragraph should communicate production capacity, quality systems, and volume requirements.

Case studies prove production capability better than capability statements. A case study titled "Delivering 250,000 Medical Device Components Annually" communicates volume in a way "precision medical manufacturing" never will. The specificity matters.

Minimum order quantities filter inquiries before they reach sales teams. If your facility requires 5,000-piece minimums for production runs, state this clearly. You'll receive fewer RFQs. The ones that arrive will be qualified.

Equipment lists demonstrate capacity when presented with context. What I know is production buyers want to see how many machines you run, what your shift structure looks like, and whether you have redundant capacity for critical operations. This information answers their questions before they ask.

Quality certifications need prominence. If you hold ISO 9001, IATF 16949, or AS9100, these belong in your header or hero section, not buried in footer text. Production buyers filter by certification before evaluating anything else.

Shift structure signals production capability. A facility running three shifts can handle different volume than one running single shift. This detail helps buyers self-qualify.

The Information Production Buyers Need

I've observed that production buyers evaluate manufacturers systematically. They're checking boxes on a qualification matrix before they submit RFQs. Here's what typically appears on that matrix:

- Quality certifications (ISO 9001, industry-specific standards)

- Production capacity (equipment count, shift structure)

- Minimum order quantities

- Lead time capabilities for production runs

- Supply chain management systems

- Lot traceability processes

- Industry experience with similar products

- References from comparable production programs

When your website addresses these points directly, you're speaking the language production buyers use internally. When your website focuses on general capability and quality statements, you're requiring them to call and ask basic qualification questions.

What happens is production buyers often don't call. They move to manufacturers who answered their questions on the homepage.

The Conversion Problem Nobody Discusses

The real cost isn't the time spent quoting prototype work. It's the production opportunities that never materialized because qualified buyers couldn't verify capability.

Picture this: A procurement manager at an automotive Tier 1 supplier searches for contract manufacturing partners. She needs a production partner for a suspension component. Annual volume: 180,000 parts.

She opens multiple websites. What I typically see manufacturers displaying is similar content. Generic manufacturing language. Stock photos of CNC machines. No capacity details. No quality certifications visible. No minimum order quantities.

She closes those tabs and keeps searching.

The sites that remain clearly state ISO 9001 and IATF 16949 certification. They show annual production capacity. They display case studies for automotive components with comparable volume.

Those are the RFQs she submits.

The generic sites never knew she visited. Their analytics show a bounce. They assume she wasn't a qualified buyer. She was. She just couldn't verify they were qualified suppliers.

Moving From Generic to Production-Specific

The shift requires confidence in positioning. You'll attract fewer total inquiries. You'll turn away prototype work. You'll tell startup founders your minimums don't fit their needs.

You'll also start receiving RFQs from OEMs who need production partners, not shops that take any work. One automotive production program worth $400,000 annually beats three hundred prototype quotes worth $800 each that convert at 5%.

Production buyers are searching for partners. They just can't tell production facilities apart from prototype shops when everyone uses the same positioning language.

Repositioning for Production Buyers

This problem is fixable. It requires repositioning your website content to communicate production capacity instead of general capability. The shift means stating equipment counts, shift structures, minimum order quantities, and quality certifications prominently.

Sometimes manufacturers need external perspective to identify what's missing from their messaging. The language that feels obvious internally often doesn't communicate what buyers need externally.

I work with contract manufacturers to restructure website content for production buyer qualification as part of a holistic marketing strategy. We identify the capacity details, certifications, and operational specifics that need prominence. Contact Mansfield Marketing to request a quote or call (713) 936-5557 to discuss repositioning your contract manufacturing marketing from prototype inquiries to production opportunities.

Written by Doug Mansfield | President, Mansfield Marketing

Connect with Doug Mansfield on LinkedIn