We got it.

Thank you for contacting us.We’ll get back to you as soon as possible.

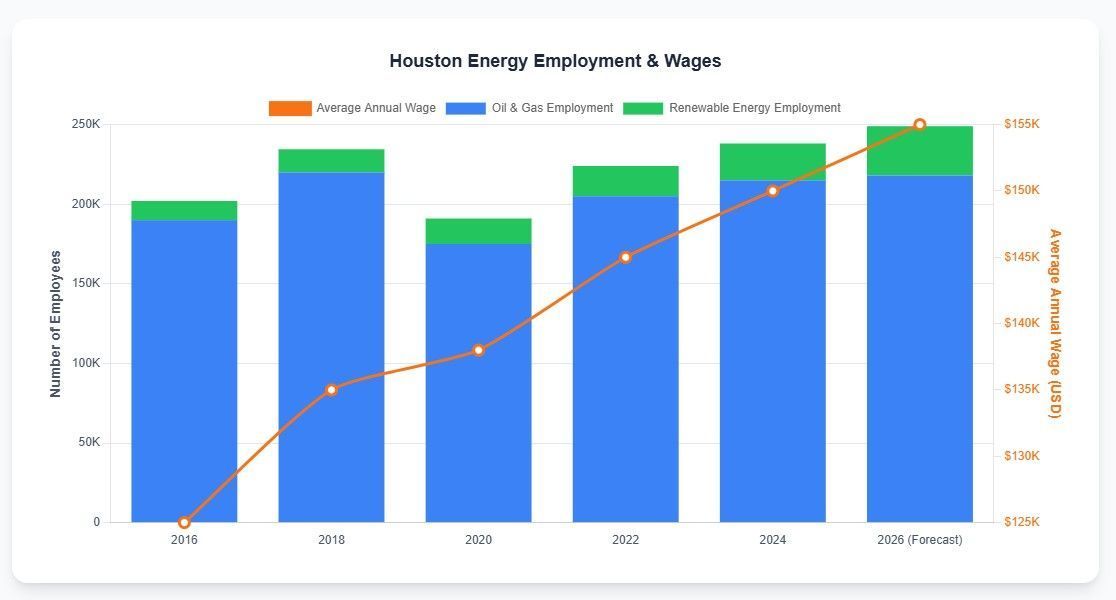

Houston Energy Sector Economic Impact & Forecast on Employment & Wages from 2016 Through 2026 (Forecast)

By Doug Mansfield • October 13, 2025

Houston Energy Chart

This chart summarizes the key economic indicators for the Houston metropolitan area's energy sector from 2016 to 2024, with an Employment and Wages forecast for 2026. The data illustrates a decade of significant volatility and structural change, marked by cyclical oil and gas prices, major global events, and the accelerating rise of renewable energy and energy transition technologies.

Timeline: Key Developments & Economic Context

• 2016

Severe downturn following the (713) 936-5557 oil price crash. Widespread layoffs in the upstream sector. West Texas Intermediate (WTI) crude oil prices average ~$43/barrel.

• 2018

Strong recovery period. Oil prices rebound (WTI avg. ~$65/barrel), leading to renewed hiring and investment in the Permian Basin. Early signs of growth in solar and wind sectors.

• 2020

Dual shock of the COVID-19 pandemic and an oil price war leads to a sharp, sudden downturn. Negative oil prices are seen for the first time. The renewable sector shows resilience.

• 2022

Post-pandemic economic reopening and geopolitical events cause energy prices to surge (WTI avg. ~$95/barrel). Strong hiring returns to oil and gas, and the energy transition gains significant momentum.

• 2024

Market stabilization. Renewable energy becomes a major job creator, representing 1 in 12 new jobs in the region. Houston leads the nation in wind energy employment and sees a 45% YoY growth in solar jobs.

• 2026 (Forecast)

The 'dual energy' economy matures. Oil and gas employment remains stable, driven by LNG exports and efficiency gains. Renewable energy and energy transition (CCUS, Hydrogen) jobs see accelerated growth, driven by massive electricity demand forecasts by ERCOT.

Footnotes & Sources

- Note on Data: Employment and wage figures are approximate and compiled from multiple sources. The 2026 figures are forecasts based on current trends and projections.

Oil & Gas Subsector Employment: Includes Upstream, Midstream, Downstream, and Oilfield Services. Data synthesized from reports by the Texas Workforce Commission, BLS, and Greater Houston Partnership (GHP). - Renewable Energy Subsector Employment: Includes jobs in solar, wind, battery storage, and smart grid technology. Data sourced from GHP's "Economy at a Glance" reports.

- Average Annual Energy Wage: Represents an average across the entire energy sector. Sourced from BLS and GHP data.

- Greater Houston Partnership, "Economy at a Glance - September 2025." Provided recent historical data points.

- U.S. Energy Information Administration (EIA), "Short-Term Energy Outlook." Informed projections on the traditional sector.

- Electric Reliability Council of Texas (ERCOT) Forecasts. Highlighted future electricity demand driving renewable investment.

Written by Doug Mansfield | President, Mansfield Marketing

Connect with Doug Mansfield on LinkedIn